Stash, February 2020

Last year we booked tradies to begin the final stages of renovating our old wooden house. Nothing too major, a few repairs and a lick of paint. So, naïve… The scaffolders arrived on Monday as planned and wrapped our little house in iron bars. Our builders found major repairs in addition to our minor ones. Then the six months of bone dry weather ended with some serious rain. Australians do not work when it rains.

In addition to these final (and possibly lengthy) abortive house renovations (scaffolders; builders; roofers; painters and tree loppers) plus our new jobs we have begun the process of buying a house in Broken Hill. Everything happens at once doesn’t it?

In my Stash! post last month I was inspired (amongst others) by Pat the Shuffler and Aussie Firebug to start posting my own financial situation. My financial plans up until recently have been vague at best. After all life is for living not for tabulating into spreadsheets. However, there comes a stage in everyones life when it pays to pay attention.

It is time for my monthly summary of my underwhelming finances. I am still working out my preferred way to present this information. The aim is to motivate myself to pay off my debts, save my wages and put something away for when I’m old and buggered. Pretty basic really.

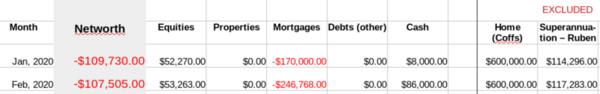

Net Earnings

- $3,830 (January)

- $27,396 YTD

Superannuation

- $117,283

Cash in the bank

- $86,000

Owed on Mortgage (Rate: 3.38%)

- $246,768

Home

Last month I was being a negative nancy. Our little house would probably fetch more than the $500k I suggested.

- $600,000

Equities

I keep meaning to change my allocation but for now I have made no changes since last month. This is what they are currently worth.

- $53,263

Summary

We have not saved much this month. We had to buy expensive tickets to fly out to Broken Hill to find a house. I will also be going to Sydney with MJD. We have redrawn our mortgage in preparation for paying a house deposit and paying for our renovations.

Last months final snapshot was probably a bit wrong so here is my current interpretation of the situation. In Australia we are not allowed to touch our Superannuation until retirement so I am not including it. I am also not including the value of our home as I will always need a home therefore it is not an asset. I am including the debt though because that needs to go. I have also stopped dividing all the numbers by two, my partner and I are in this together.

Next month we will hopefully succeed in getting finance for a second mortgage for the Broken Hill house. My Mum and JB will be visiting from the UK and I will be taking time off work and have some fun planned with them. In terms of FI/RE I am definitely going backwards but this is LI/FE.

Edited for clarity 11/02/2019

Comments

Add a comment?There are no comments yet.