Stash!

Fifteen years ago I was following the founder of the Moxie cinema as he tried to work out his business. He shared his plans and budget on his blog and asked for comments. This was one of the things I loved about the internet. Suddenly we could share our thoughts and ask for advice from our community. I posted this around that time:

The Moxie Budget

That in a nutshell is probably why I am so bad at being self-employed. I have never really got past the moral dichotomy of being a capitalist or a socialist. More recently I have been simultaneously inspired (by the sensible investments) and repulsed (by the unchecked priviledge and tax evasion) at the FIRE movement. Reading the FIRE; Boglehead and Barefooter blogs have inspired me to share the financial devastation that is the result of my life.

Unlike all the the young-guns out there, planning their early retirements, I am too late. The miracle of compound interest is beyond my grasp. As you will see below there is not much hope of me spending my autumn years in unbridled luxury. January is the traditional month for fools making commitments so here goes.

I’m going to post a monthly summary of my underwhelming finances in the hopes of inspiring me to improve.

Earnings

- Gross $6,720 (December) | $32,114 (YTD)

- NETT $3,794 (December) | $23,566 (YTD)

Nowadays I work as a Nurse and my wages are directly proportional to how much work I put in. No fancy KPI bonuses for me. If I put in some hard yards on night shifts, weekends pick up extra shfts I can pull in more. Hard yakka is my main leverage to increase my funds.

Superannuation

- $114,296

This is with the First State Super High Growth units. 2018-2019 returned 8.2% with $998 fees. I have paid in $2,802 so far this year. I am considering changing to a HostPlus Index fund to reduce fees.

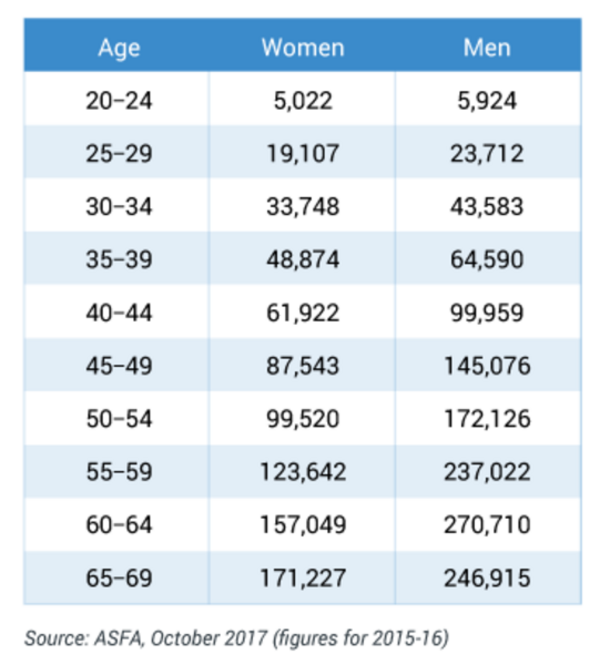

The Australian Tax Office allows a ‘Concessional Contribution’ cap of $25k. This is the first year they are allowing us to Carry-forward to the next year for a five year window. However It would be better for me if I could somehow stack some more money in before June. Here is a table (data from 2015-16) I found which shows the median amount of Super Australians have depending on their age:

Cash in the bank

- $8,000

Owed on Mortgage (Rate: 3.38%)

- $170,282

I share this mortgage with my partner so technically I only owe $85,141. We are about to do some refurbs on our house. Some of the timber holding the roof up is rotten so it’s not going to be cheap. I expect the mortgage will go backwards in the short term. I find this depressing.

Home

- $500,000

I don’t really know what our house is worth but hopefully it’s worth more than our mortgage debt.

ETF Holdings

- $52,031

I am considering liquidating some of these. I can use the cash as a living expense. A larger proportion of my wages can then go into my Superannuation. I’ll be taxed when I sell the ETF’s but I think I’ll save that by reducing tax on my Super Contibutions.

GOLD(15); IAF(35); IEM(104); VAS(211); VGS(232)

I have left out our living expenses and my partners finances because it’s not up to me to share her business with random denizens of the internet.

A bald monetary snapshot of what I’m worth right now would be 8k cash + $52k equities - $85k mortgage = -$25k

Comments

Add a comment?There are no comments yet.